A home is your resting place, where you go to unwind from the stress of the world. For you to enjoy your home, you need to identify the perfect one you wish for yourself. In this article, we will help you on your path and empower you with the knowledge you need.

Meanwhile, Homelendingpal website has a plethora of articles that might prove crucial for you in both cases if you are going to find and buy a house and even after the home purchase process. Proceed to the website and make use of the information today.

Research

As soon as you have made the decision to purchase a home, research is key. Make use of newspapers, magazines and social media platforms. Peruse the real estate listings and note houses that interest you. Also, make a note of the features, amenities, neighborhood and the prices. This will enable you to have a feel of what the market is offering.

What can you afford?

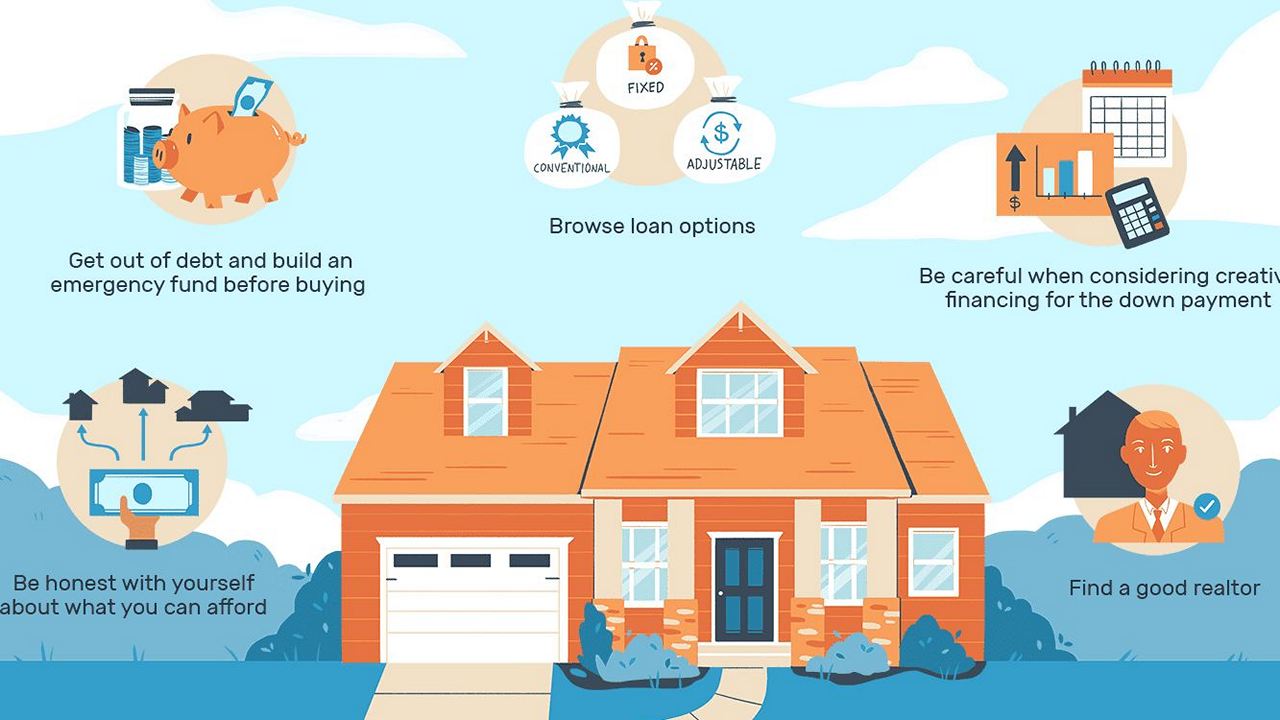

Lenders and financiers will be gunning on you to purchase costly homes in the area. This could be more than what you can afford on a long-term basis. We recommend that you make a decision based on your financial situation, from both a short- and long-term position.

Prequalification and preapproval

Once you have locked down on the price and potential home, you will need to get a prequalification and preapproval for your mortgage. Though they sound similar and are used interchangeably, the two terms have different meanings.

At the end of the process, your financial institution will confirm whether they can provide you with the funds based on the financial information available.

A real estate agent

While you might have chosen a prospective neighborhood, the services of a real estate agent might come in handy. Due to their qualification and experience, they provide localized knowledge that is not in public domain. Their familiarity might prove to be the difference as you purchase your real estate home.

House inspections

It is recommended that you inspect every room and inch of your potential home. It is prudent to make a short list of the areas of interest. You will be checking for defects and issues with the fittings, amenities and other utilities offered.

If you feel overwhelmed with the task, consider the services of a home inspector. Their findings are usually compiled in a report that will reveal the true condition of the property.

A home appraisal

If you are taking a mortgage, your financier will organize for an appraiser to come to your property. The appraiser is an independent party who will assess the property and provide the bank with a report on the fair price of the property as well as other value drivers.

Closing of the sale

Paperwork will be in plenty. For the purchase to go through, all paperwork with the financier and the seller needs to be signed. It is once these contracts are fulfilled you will be able to move into your new home.