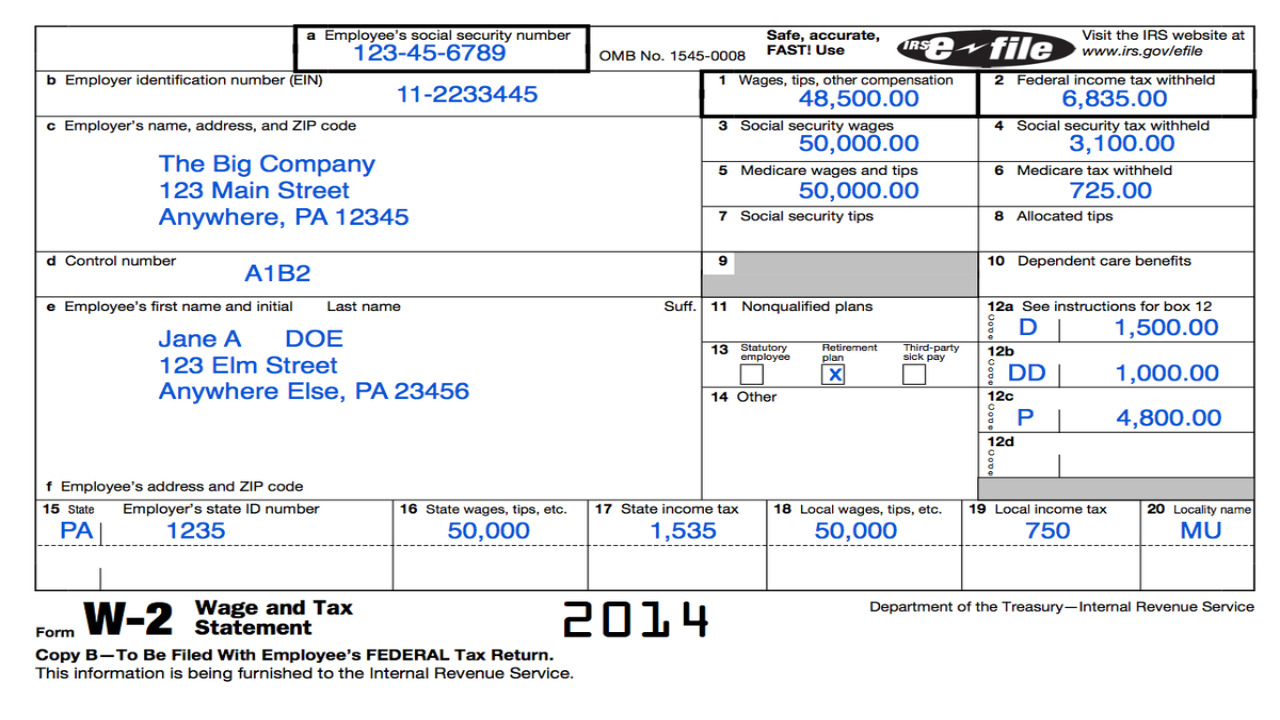

The W-2 form, also known as the Wage and Tax Statement, is a crucial document that every employed individual in the United States receives from their employer at the end of each tax year. This form provides essential information about your earnings and taxes withheld, which you’ll need to accurately file your federal and state income tax returns. Filling out the W-2 form correctly is vital to avoid any potential tax-related issues. In this guide, we will provide a step-by-step explanation of how to complete your W-2 form accurately.

Step 1: Gather Your Information

Before starting the process, gather all the necessary information. This includes your full name, address, Social Security Number (SSN), and other personal details. Additionally, you will need your employer’s Employer Identification Number (EIN) and the company’s address. Collect your pay stubs or other income documents, as they will help you accurately report your earnings and deductions. To fill out the form, you can use a W-2 creator online.

Step 2: Identify Boxes on the W-2 Form

Understanding the various boxes on the W-2 form is essential for proper completion. There are specific boxes for reporting different types of income, tax withholdings, and deductions. The form is typically divided into three sections: employee information, employer information, and wage and tax information.

Step 3: Complete Employee Information

Enter your full legal name, address, and SSN in the designated boxes. Double-check the accuracy of this information, as any mistakes can lead to processing delays or errors in your tax returns.

Step 4: Enter Employer Information

Next, fill in your employer’s name, address, and EIN in the respective boxes. Again, ensure that the details provided are accurate, as any inaccuracies could lead to complications during tax filing.

Step 5: Report Wage and Salary Information

The most crucial section of the W-2 form is where you report your wage and salary information. This includes your total earnings for the year, as well as any tips received, bonuses, or other taxable compensation. Enter this information in Box 1.

Step 6: Account for Federal Income Tax Withholding

Box 2 displays the total amount of federal income tax withheld from your earnings throughout the year. Your employer deducts this amount from your paychecks based on the information you provided on your Form W-4. Double-check the accuracy of this figure, as it directly impacts your tax liability and potential refund.

Step 7: Consider Social Security and Medicare Taxes

Boxes 3 and 4 show the amounts withheld for Social Security and Medicare taxes, respectively. Social Security tax has a wage base limit, so ensure that the correct amount is withheld based on the current year’s limit. Medicare tax, on the other hand, has no wage base limit.

Step 8: Account for State and Local Taxes

If you live in a state or locality with income tax, Boxes 15 to 17 will require you to report the wages, tips, and other compensation subject to state and local taxes. Additionally, you’ll need to report the amounts withheld for state and local income tax in Boxes 16 and 18, respectively.

Step 9: Include Other Deductions and Benefits

Box 12 may contain various codes and corresponding amounts that represent other deductions, benefits, or contributions, such as retirement plan contributions or health savings account (HSA) contributions. Make sure to accurately report these items if applicable.

Step 10: Verify and Submit

Carefully review all the information you have entered before submitting your W-2 form to your employer. If you notice any errors or discrepancies, inform your employer immediately to have them corrected.

Conclusion

Filling out your W-2 form correctly is crucial for accurate tax reporting and minimizing potential issues with the Internal Revenue Service (IRS). By following this step-by-step guide and ensuring all your information is accurate, you can confidently complete your W-2 form and proceed with filing your tax return. Remember that the W-2 form deadline is typically on or before January 31st, so be proactive in obtaining and reviewing your W-2 form each year.